Rowan County Nc Property Tax Due Dates . when are property taxes due? the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. Taxes are due september 1. taxes on real estate and personal property are due on september 1 and are payable through january 5. Search by name, account, bill number, parcel id or address. if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property tax due date, or. when are taxes due? For real estate, individual personal property, and business personal property, taxes are due. tax year due date base taxes penalty, interest and fees cumulative due; If january 5 falls on a. You have until january 5 to pay without penalty. tax year due date base taxes penalty, interest and fees cumulative due;

from mavink.com

when are taxes due? You have until january 5 to pay without penalty. when are property taxes due? Taxes are due september 1. tax year due date base taxes penalty, interest and fees cumulative due; if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property tax due date, or. taxes on real estate and personal property are due on september 1 and are payable through january 5. Search by name, account, bill number, parcel id or address. If january 5 falls on a. tax year due date base taxes penalty, interest and fees cumulative due;

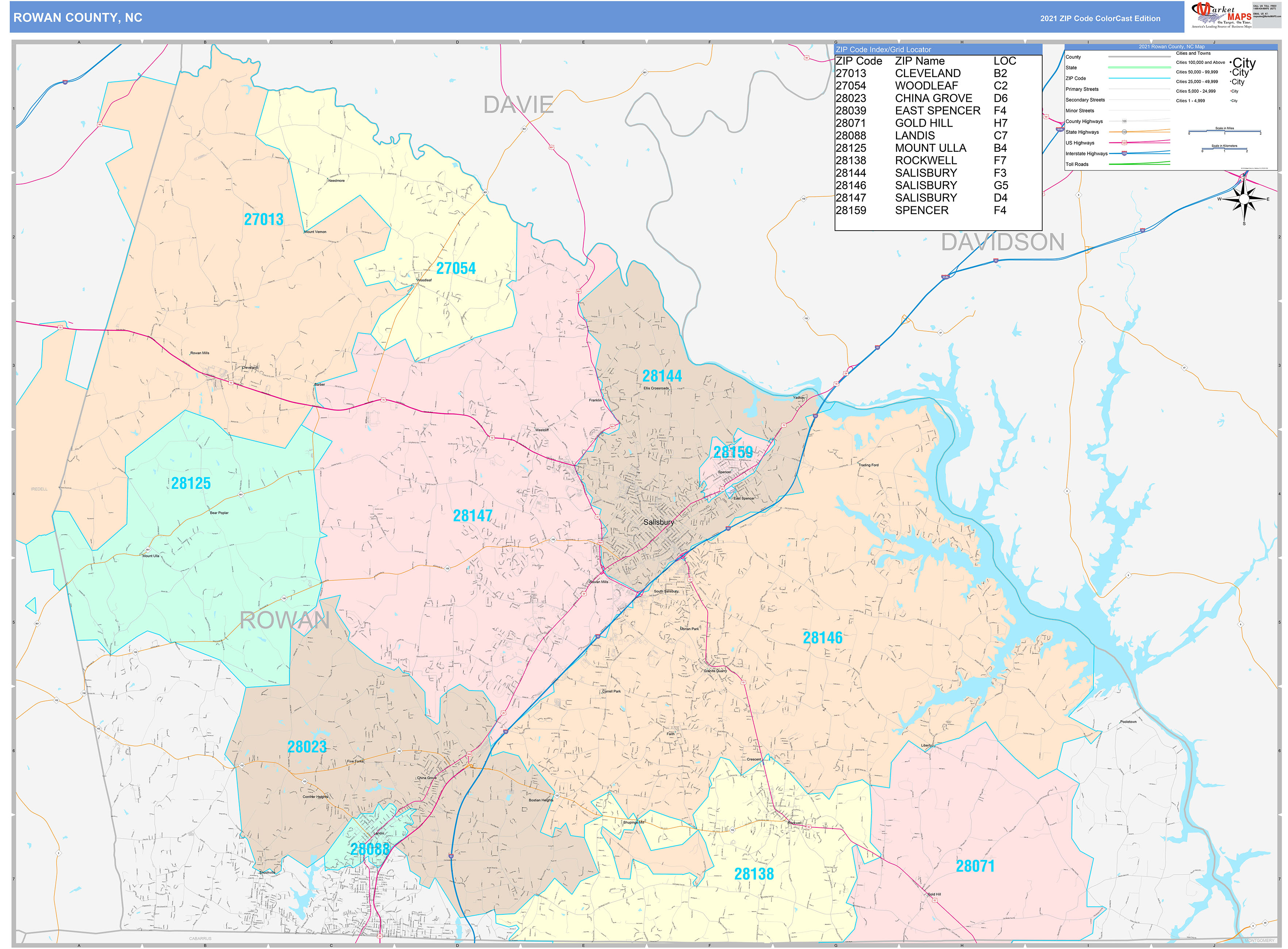

Rowan County Precinct Map

Rowan County Nc Property Tax Due Dates For real estate, individual personal property, and business personal property, taxes are due. when are property taxes due? the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. If january 5 falls on a. when are taxes due? Taxes are due september 1. tax year due date base taxes penalty, interest and fees cumulative due; tax year due date base taxes penalty, interest and fees cumulative due; taxes on real estate and personal property are due on september 1 and are payable through january 5. if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property tax due date, or. Search by name, account, bill number, parcel id or address. For real estate, individual personal property, and business personal property, taxes are due. You have until january 5 to pay without penalty.

From doreamichaeline.pages.dev

Ca Property Tax Due Dates 2024 Kylen Minerva Rowan County Nc Property Tax Due Dates when are property taxes due? taxes on real estate and personal property are due on september 1 and are payable through january 5. tax year due date base taxes penalty, interest and fees cumulative due; If january 5 falls on a. Taxes are due september 1. the tax collector’s office collects ad valorem tax for rowan. Rowan County Nc Property Tax Due Dates.

From pastureandpearl.com

When Are Property Taxes Due In Cook County August 2024 Rowan County Nc Property Tax Due Dates You have until january 5 to pay without penalty. taxes on real estate and personal property are due on september 1 and are payable through january 5. tax year due date base taxes penalty, interest and fees cumulative due; the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. . Rowan County Nc Property Tax Due Dates.

From tax.rowancountync.gov

Rowan County Personal Property Search Rowan County Nc Property Tax Due Dates when are property taxes due? tax year due date base taxes penalty, interest and fees cumulative due; If january 5 falls on a. Taxes are due september 1. taxes on real estate and personal property are due on september 1 and are payable through january 5. when are taxes due? For real estate, individual personal property,. Rowan County Nc Property Tax Due Dates.

From www.financestrategists.com

Find the Best Tax Preparation Services in Rowan County, NC Rowan County Nc Property Tax Due Dates taxes on real estate and personal property are due on september 1 and are payable through january 5. if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property tax due date, or. when are property taxes due? Search by name, account, bill number, parcel id or. Rowan County Nc Property Tax Due Dates.

From www.ezhomesearch.com

Guide to Living in Rowan County North Carolina Rowan County Nc Property Tax Due Dates If january 5 falls on a. You have until january 5 to pay without penalty. tax year due date base taxes penalty, interest and fees cumulative due; For real estate, individual personal property, and business personal property, taxes are due. the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. . Rowan County Nc Property Tax Due Dates.

From www.rowancountync.gov

Rowan County Rowan County Nc Property Tax Due Dates the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. when are taxes due? Taxes are due september 1. Search by name, account, bill number, parcel id or address. taxes on real estate and personal property are due on september 1 and are payable through january 5. You have until. Rowan County Nc Property Tax Due Dates.

From www.carolana.com

1949 Road Map of Rowan County, North Carolina Rowan County Nc Property Tax Due Dates If january 5 falls on a. Taxes are due september 1. You have until january 5 to pay without penalty. when are taxes due? For real estate, individual personal property, and business personal property, taxes are due. the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. tax year due. Rowan County Nc Property Tax Due Dates.

From www.ezhomesearch.com

The Ultimate Guide to North Carolina Property Taxes Rowan County Nc Property Tax Due Dates For real estate, individual personal property, and business personal property, taxes are due. taxes on real estate and personal property are due on september 1 and are payable through january 5. tax year due date base taxes penalty, interest and fees cumulative due; when are property taxes due? If january 5 falls on a. You have until. Rowan County Nc Property Tax Due Dates.

From gaylaqchristi.pages.dev

Cook County Property Tax Due Dates 2024 Wilie Julianna Rowan County Nc Property Tax Due Dates If january 5 falls on a. tax year due date base taxes penalty, interest and fees cumulative due; taxes on real estate and personal property are due on september 1 and are payable through january 5. if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property. Rowan County Nc Property Tax Due Dates.

From bessqlonnie.pages.dev

La County Property Tax Due Dates 2024 Fawn Martita Rowan County Nc Property Tax Due Dates when are taxes due? tax year due date base taxes penalty, interest and fees cumulative due; if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property tax due date, or. the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23. Rowan County Nc Property Tax Due Dates.

From www.salisburypost.com

No details yet as Rowan County real estate revaluation for 2023 starts Rowan County Nc Property Tax Due Dates the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. Taxes are due september 1. Search by name, account, bill number, parcel id or address. tax year due date base taxes penalty, interest and fees cumulative due; tax year due date base taxes penalty, interest and fees cumulative due; . Rowan County Nc Property Tax Due Dates.

From ncancestry.com

Rowan County North Carolina Ancestry Rowan County Nc Property Tax Due Dates You have until january 5 to pay without penalty. taxes on real estate and personal property are due on september 1 and are payable through january 5. tax year due date base taxes penalty, interest and fees cumulative due; If january 5 falls on a. Search by name, account, bill number, parcel id or address. the tax. Rowan County Nc Property Tax Due Dates.

From www.lib.ncsu.edu

County GIS Data GIS NCSU Libraries Rowan County Nc Property Tax Due Dates tax year due date base taxes penalty, interest and fees cumulative due; tax year due date base taxes penalty, interest and fees cumulative due; when are taxes due? taxes on real estate and personal property are due on september 1 and are payable through january 5. Taxes are due september 1. You have until january 5. Rowan County Nc Property Tax Due Dates.

From flossiewelane.pages.dev

Summit County Ohio Property Tax Due Dates 2024 Jean Robbie Rowan County Nc Property Tax Due Dates For real estate, individual personal property, and business personal property, taxes are due. You have until january 5 to pay without penalty. the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. tax year due date base taxes penalty, interest and fees cumulative due; if you need to pay your. Rowan County Nc Property Tax Due Dates.

From www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities Rowan County Nc Property Tax Due Dates tax year due date base taxes penalty, interest and fees cumulative due; when are property taxes due? Taxes are due september 1. If january 5 falls on a. taxes on real estate and personal property are due on september 1 and are payable through january 5. Search by name, account, bill number, parcel id or address. . Rowan County Nc Property Tax Due Dates.

From www.carolana.com

2000 Road Map of Rowan County, North Carolina Rowan County Nc Property Tax Due Dates taxes on real estate and personal property are due on september 1 and are payable through january 5. if you need to pay your property tax bill, ask about a property tax assessment, look up the rowan county property tax due date, or. tax year due date base taxes penalty, interest and fees cumulative due; tax. Rowan County Nc Property Tax Due Dates.

From www.landwatch.com

Rockwell, Rowan County, NC House for sale Property ID 416822021 Rowan County Nc Property Tax Due Dates For real estate, individual personal property, and business personal property, taxes are due. tax year due date base taxes penalty, interest and fees cumulative due; taxes on real estate and personal property are due on september 1 and are payable through january 5. You have until january 5 to pay without penalty. if you need to pay. Rowan County Nc Property Tax Due Dates.

From mavink.com

Rowan County Precinct Map Rowan County Nc Property Tax Due Dates tax year due date base taxes penalty, interest and fees cumulative due; tax year due date base taxes penalty, interest and fees cumulative due; when are property taxes due? the tax collector’s office collects ad valorem tax for rowan county, 10 municipalities, and 23 fire districts. You have until january 5 to pay without penalty. . Rowan County Nc Property Tax Due Dates.